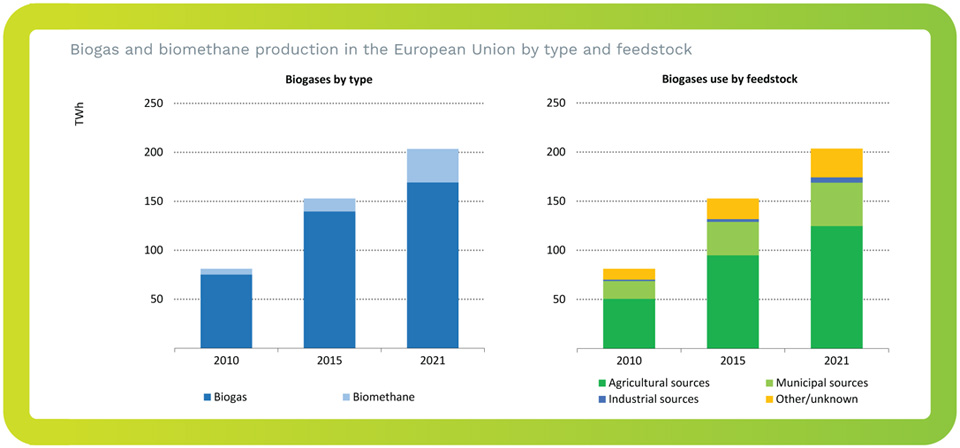

The EU's biogas and biomethane industry is growing, and has been given a large boost by the RePowerEU plan, which aims to achieve a target of at least 35 bcm (350 TWh) annual biomethane production by 2030.

There are many EU and national policies already in place that support biogas and biomethane, and several near-term actions are proposed in the RePowerEU plan to support its development. An industry partnership has been proposed that would serve as a platform for public-private engagement and the sharing of best practices around permitting, financing, incentives and environmental regulations. The EU plan encourages national biomethane strategies to evaluate potential and identify barriers to production as well as enabling conditions at the local and national levels. It also suggests an integration of biomethane into an EU-wide strategy for rural development and local job creation, including the use of energy communities and farmers cooperatives.

The growth in biomethane production envisioned in the RePowerEU plan would imply a 40% average annual growth rate from 2023-30 compared to 17% between 2015-2021. Factors that could accelerate growth include streamlined permitting procedures, factory-style fabrication of standardised biodigesters and related equipment, dedicated biogas fi nancing facilities, and robust support schemes such as quotas, feed-in tariffs, and contracts for difference, in addition to an EUwide system for low-carbon gases certification.

Potential and costs of biomethane in the EU

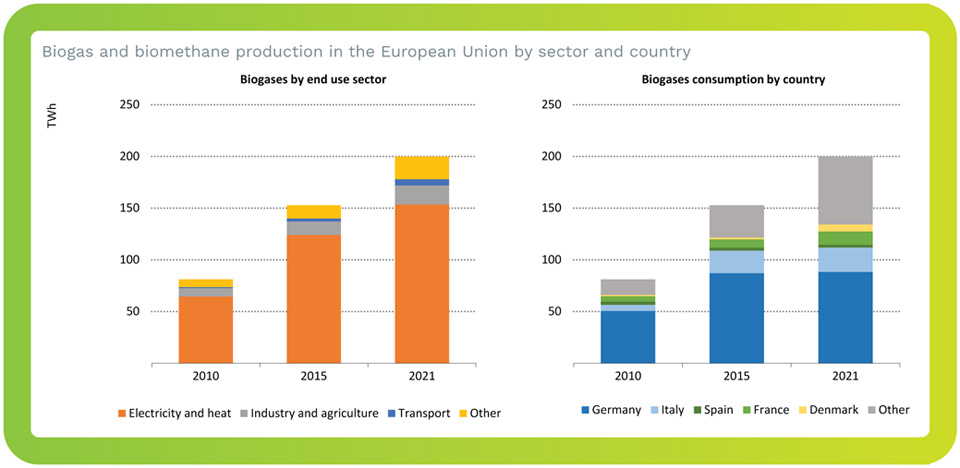

The IEA has produced country-level estimates of the feedstock potential within the European Union, using Eurostat, FAO and World Bank data. The largest potential lies in Germany, France, Spain and Italy, owing to their size, population and relatively large gross agricultural output. Comparing potential to the size of the gas market, the Nordic and Baltic States have significant quantities of available feedstock that can be converted to biomethane, in some cases exceeding annual natural gas demand requirements.

Our analysis suggests that 35 bcm of biomethane can be produced in the EU for less than USD 20/MBtu, at an average near USD 15/MBtu. This is below the prices seen since July 2021, but well above the average of the past decade. It also does not include injection costs into pipelines or compression/liquefaction costs if transporting the gas in this way. These overall estimates depend on three main cost elements: feedstock, biodigesters and gasification units and grid connection costs.

Key issues for scaling up biomethane production

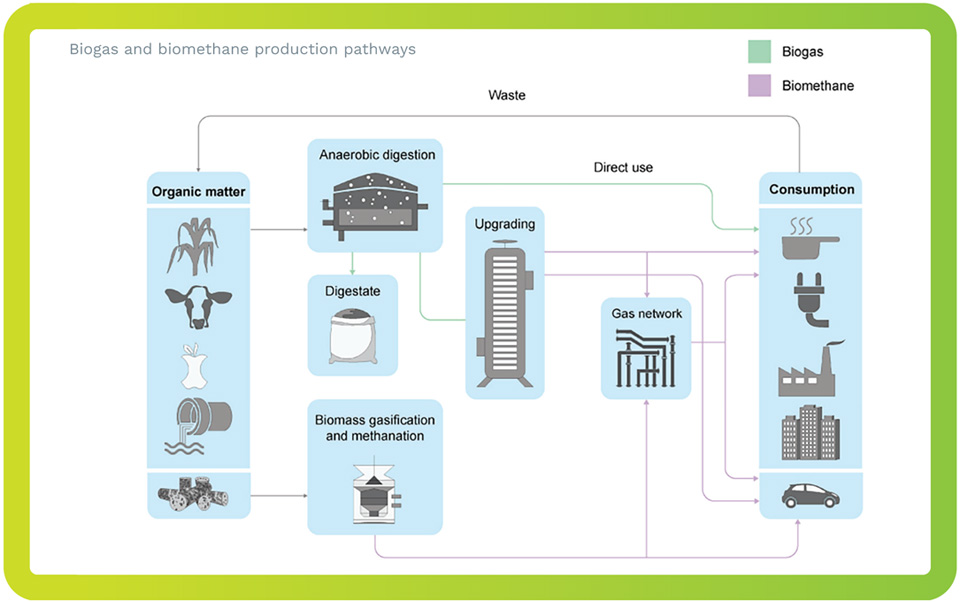

There are several outstanding considerations regarding the sustainability, cost and technical characteristics of different biomethane production pathways, and these will need to addressed in order to responsibly achieve the biomethane production targets in the EU.

One issue warranting further investigation is the lifecycle emissions of different biomethane production pathways. Key issues are the extent to which open storage of cattle slurry or residual digestate from the production process leads to significant levels of fugitive methane emissions. Other emissions might arise from the collection, processing and transport of different biogas feedstocks, which need to be weighed against the CO2 emissions that arise during the production, processing and transport of natural gas. On the other hand, some of the feedstocks that are used to produce biomethane would decompose and produce methane emissions naturally if not captured by a biogas production process.

On the logistics side, a very significant barrier to collection of cattle manure is an animal husbandry system whereby cattle are pasture grazed for the majority of the year, making manure collection difficult. If crop residues are chosen as the main feedstock, it is important to consider their use as animal feed, and the fact that a signifi cant portion is kept in the soil to maintain a sustainable amount of nutrients and avoid soil erosion.

Therefore, reserving crop residues for use in biogas production must be carried out as one part of a wider agricultural and land management plan. There are also prospects for the use of sequential crops for biogases production, grown between two harvested crops as a soil management solution that helps to preserve the fertility of soil, retain soil carbon and avoid erosion. Sequential cropping has been tested at scale in Italy through the BiogasDoneRight concept.

Notwithstanding current record high gas prices, the production and utilisation of biomethane requires supportive access to fi nancing and incentives to become competitive. A large-scale biogas project with a capacity of around 500 m3/hr can cost approximately €1.5 to 2 million.

Financing support is therefore necessary for many project sponsors, but banks often lack technical expertise in this area and there are few benchmarks to assess the unique risk/return profi le for biomethane projects. These gaps can increase the perception of risk, raising the cost of capital or reducing the loan tenures.

The road ahead

Expanding biomethane production to 35 bcm will require a 12-fold increase in biomethane production across EU in less than 8 years. To meet this ambitious timeline, policymakers should focus their efforts on the following key areas:

- Close the competitiveness gap. Notwithstanding current record high prices for natural gas, further incentives are needed that give biomethane a value linked to its GHG performance, alongside multiple co-benefits (rural development, dispatchable generation, avoided methane emissions, value of digestate as biofertiliser, etc).

- Improve feedstock management. The majority of the EU biogas production comes from landfills, wastewater treatment, energy crops and some agricultural wastes like manure. Biogas producers will need to scale supply chains for these wastes and construct many efficient facilities to use these feedstocks. Standards should be put in place that avoids negative impacts on soil and nutrient cycles, farm management practices, biodiversity, or animal husbandry.

- Facilitate investment: Meeting the 35 bcm target will require EUR 70 billion of new investment, according to the RePowerEU plan. Reducing the risk of biogas and biomethane investment by extending public financing or loan guarantees, or by securing long-term offtake agreements with creditworthy buyers, can help fi nance larger projects and therefore attract larger private sources of capital.

- Measure, report and verify emisssions. There remains considerable uncertainty around the lifecycle emissions of biogas and biomethane plants. Operators should be obliged to measure and report their emissions at each stage of the production process.

- Increase facility sizes: Most biomethane units in the EU have a capacity to produce around 50-250 m3/h. Plant sizes will likely need to increase, potentially requiring the pooling of multiple feedstock sources and development of centralised upgrading facilities, in order to achieve economies of scale and reduce integration costs.

- Prepare gas networks for biomethane injection: Natural gas network operators will need to accomodate higher rates of biomethane injection, that comes with different supply profiles and quality specifications, while maintaining reliable supplies.

- Create a harmonised trading network: Trade can help expand the pace and scale of biomethane growth by connecting production and demand centres. This requires consistent biomethane standards, trading platforms for physical and greenhouse attribute trading and shared sustainability certification.