The use of financial instruments (FIs) supported by the European Structural Investment Funds (ESIF) is proving to be a more sustainable and efficient way to invest in growth and development than the classic non-returnable grant.

The use of financial instruments (FIs) supported by the European Structural Investment Funds (ESIF) is proving to be a more sustainable and efficient way to invest in growth and development than the classic non-returnable grant.

In the current 2014-2020 period, the Operational Programs (OPs) of the Member States (MS) plan to use 20 billion euros from ERDF and CF (about 8% of the total) for FIs, nearly double than the 11 billion euros of the previous period 2007-2013.

The financial products in larger use are currently loans and equity, or quasi-equity, with a lower introduction in the market of guarantees and multiproduct. This was also repeated in 2007-2013, mainly due to the intensification of FIs in the SME and RTD thematic objectives.

However, 2014-2020 presents a large number of FIs samples in the energy field, covering loans, guarantees and multiproduct. Extremadura Region is one of these samples.

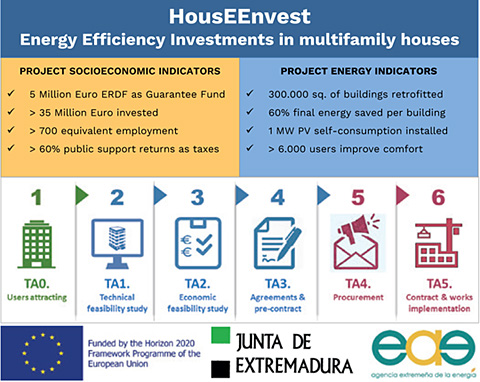

Extremadura Region has designed a Guarantee Fund of 5 million euros ERDF from the ROP, which will cover the risk of the Commercial Banks when lending 35 million euros for energy retrofitting of condominiums.

Extremadura is going to combine 5 different fund sources in order to mobilize the final investments:

- The OP provides the guarantee to the commercial banks.

- Commercial banks leverage with private investment until 35 million.

- Finerpol project (Interreg Europe) funded the ex-ante assessment.

- Rehabilite project (Interreg SUDOE) funded the capacity building platform.

- HousEEnvest (H2020) will provide the technical assistance for the investment implementation through a one-stop-shop.

Some conclusions from Agenex (Extremadura Energy Agency) experience:

- Commercial banks are willing to increase their portfolio of clients through investing in new projects. However, due to the lack of references, the energy efficiency in buildings is still perceived as a risky investment when it includes full retrofitting and external insulation.

- The intervention of public sector is necessary in order to provide de-risking systems, which has to be offered through financial products such as Guarantees, and through integral market assistance such as one-stop-shops.

- EC initiatives were very valuable in the process of definition of Extremadura FI ( Fi-Compass, Smart Finance for Smart Buildings Initiative, Sustainable Energy Investment Forums, EEFIG, DEEP or Managenergy), and their necessity will increase for the definition of the coming 2021-2027.

- Specific training is recommended for Managing Authorities all over Europe, to be able to manage FIs in OPs, and to analyse the results from ex-ante assessments. Managenergy initiative, together with National, Regional and Local Energy Agencies can play an important role in the analysis of the market gap to be covered by the FI.

Contact information

Javier Ordonez, Head of International Area

AGENEX – Extremadura Energy Agency

Email: jordonez@agenex.org