As a civil-military intergovernmental organisation EUROCONTROL's role is to support European aviation with our data and expertise and actively facilitate a collaborative approach to the aviation sector's challenges.

As a civil-military intergovernmental organisation EUROCONTROL's role is to support European aviation with our data and expertise and actively facilitate a collaborative approach to the aviation sector's challenges.

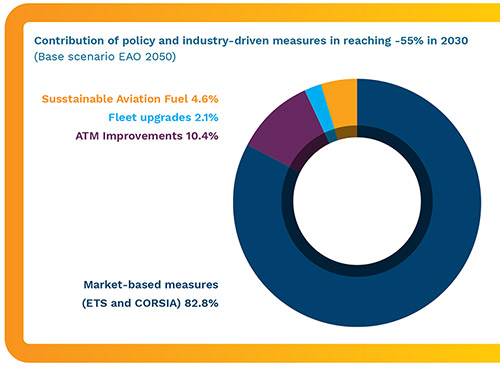

Transforming the sector towards more sustainability and achieving a CO2 emissions reduction by 55% by 2030 compared to 1990 levels is a strategic priority to which EUROCONTROL contributes by improving air traffic performance, supporting States and aviation stakeholders in their emission reporting obligations, carrying out environmental impact assessments and many more activities. Our new Objective Skygreen Think Paper and companion report examined a key question for the sustainability transition: can aviation achieve its emission targets and how much is it going to cost? The results show yes, it can, but only if it relies heavily on marked-based measures mainly via the EU Emissions Trading System (ETS) and CORSIA, which will make an 83% contribution to the net reduction in 2030.

We have looked closely at the impact of decarbonisation policies up until 2030 to assess the extra cost of Sustainable Aviation Fuel (SAF) uptake, the impact of ramping up kerosene taxes, and the phasing out of free emissions allowances. Our estimates show that the cumulative extra cost of these decarbonisation measures to the aviation industry over the period 2022-2030 will amount to €62 billion, made up of: €29 billion in tax costs on kerosene (applied to intra-EU flights), €23 billion in extra ETS costs (applied to intra-EEA flights + flights from UK & Switzerland), €10 billion in extra fuel mix costs (based on a 5% SAF / 95% kerosene mix in accordance with the ReFuelEU Aviation proposal).

The extra cost to the airline industry in 2030 alone is estimated at €14 billion. However, improvements led by the aviation industry (operational measures and modernising airline fleets) are capable of bringing the extra cumulative costs over 2022- 2030 significantly down from €62 billion to €29 billion.

Objective Skygreen is based on the three possible scenarios of our long-term air traffic forecast EUROCONTROL Aviation Outlook 2050 (EAO 2050) which predicts 13.8 million flights across the European Network by 2030 and 16 million flights by 2050 (both baseline scenario) and estimates the impact of industry driven and regulatory measures. Counterintuitively, the high scenario with the most traffic is most efficient to reach net zero emissions by 2050 at lower cost, as higher revenues will drive increased investment in new technology.

Up until 2030 and beyond the use of Sustainable Aviation Fuel (SAF) must increase

The European Commission's ReFuelEU Aviation initiative is essential in enabling a swift ramp up of sustainable aviation fuel (SAF) production and usage. Directed at fuel providers it requires that conventional kerosene for aircraft is blended with SAF starting in 2025 with 2%, and then gradually increasing to 63% by 2050. The proposal also includes a subobligation for synthetic aviation fuels starting in 2030 with 0.7%, and progressively getting to 28% of e-fuels in 2050. To avoid fuel tankering and carbon leakage, an obligation is also placed on aircraft operators to uplift at least 90% of the yearly fuel required at EU airports. Increasing the use of SAF in aviation will require significant technological investments, availability of feedstocks and other developments from SAF suppliers.

The European Commission's ReFuelEU Aviation initiative is essential in enabling a swift ramp up of sustainable aviation fuel (SAF) production and usage. Directed at fuel providers it requires that conventional kerosene for aircraft is blended with SAF starting in 2025 with 2%, and then gradually increasing to 63% by 2050. The proposal also includes a subobligation for synthetic aviation fuels starting in 2030 with 0.7%, and progressively getting to 28% of e-fuels in 2050. To avoid fuel tankering and carbon leakage, an obligation is also placed on aircraft operators to uplift at least 90% of the yearly fuel required at EU airports. Increasing the use of SAF in aviation will require significant technological investments, availability of feedstocks and other developments from SAF suppliers.

Depending on the SAF production technology pathways, the range of SAF production costs is from €1,000/tonne to more than €4,500/ tonne. SAF is today typically two to six times more expensive than kerosene. Assuming an increased demand will reduce production cost, the extra cost of a 5% SAF blending share compared to 100% kerosene is estimated to be €10 billion by 2030 in the base scenario, reaching €2.6 billion in 2030 alone.

The extra costs for increasing the share of SAF are relatively low compared to EU-ETS and kerosene taxation costs. The latter, applied to intra-European flights, will e.g. increase aircraft operator costs by €28.8 billion in the period 2022-2030. Comparing these costs, it is evident that the ReFuelEU Aviation initiative brings net emissions savings at an affordable cost.

Under the EU ETS, all airlines operating in Europe, European and non-European alike, are required to monitor, report and verify their CO2 emissions, and to surrender allowances against these emissions. They receive tradeable allowances covering a certain level of emissions from their flights per year (in 2012, 85% of allowances were allocated for free). In the revision of the EU ETS Directive, the current level of free allowances will be cut by 25% annually starting in 2024, resulting in a complete phase out by 2027.

The phasing out of aviation's free emissions allowances will result in a significant increase of allowances to be auctioned (2024-2030). Given current political developments and pressure on the energy sector, we have assumed a high carbon price of €200/tonne costing airspace users between €24.1 billion (low traffic scenario) and €19.6 billion (high traffic scenario) between today and 2030.

Only if their revenue is high will aviation be in a position to put in place the investment needed for the sustainability transition. In fact, operational improvements and fleet upgrades could reduce airline fuel consumption by 9.5%-15.4% in 2030. To reduce CO2 emissions quicker, accelerated refleeting would result in significant additional CO2 emissions reduction (savings ranging from 1.7% to 5.3% over 2028-2030).

Contact details

Email: sustainability-briefing@eurocontrol.int