Today, buildings account for approximately 40% of Europe's final energy consumption, which can be significantly reduced by implementing energy efficiency (EE) measures coupled with renewables such as PV panels in buildings and automation systems that respond to the needs of the power grid. Despite the direct benefits related to these measures, renovation rates remain low due to the difficulty of attracting investments.

Benefits for the Power System Operators

Large scale renovation programmes generate multiple benefits, including avoided network and capacity extension costs for Power System Operators and the achievement of energy and carbon emission reduction goals for public authorities. Power System Operators or other public entities could thus be inclined to support building renovations in order to reap system benefits. Such a move would further increase the bankability and attractiveness of energy efficiency and flexibility investments for third party investors.

Using Pay-for-Performance to capture system benefits

To help the market take advantage of this approach for the purpose of reducing building’s energy consumption and securing the stability of the power grid, the EU funded SENSEI project explores how to reward energy efficiency in buildings as an energy resource and/ or grid service. It examines how aggregating individual renovation projects (financed through Energy Performance Contracting agreements) towards a portfolio of buildings can offer their cumulative demand reduction as a service to the grid. This is based on the Pay-for-Performance (P4P) approach, where indirect beneficiaries of renovation measures (e.g. TSOs) would distribute payments to Aggregators of renovation projects, based on the measured reductions or shifts of energy demand at the grid level. This measurement of energy savings can happen with advanced Monitoring & Verification algorithms of tools sometimes referred to as M&V 2.0 such as CALTRACK, IPMVP, or EENSIGHT. The use of M&V 2.0 creates numerous possibilities in the field including the accurate monitoring of energy savings from public renovation programmes, the automated reporting of savings from Energy Efficiency Obligations, or the ability to set up contracts and financial products linked to achieved energy efficiency and flexibility services.

The SENSEI project has therefore developed a model based on Payfor- Performance (P4P) depicting how renovation projects can be aggregated to attract interest from financial institutions that wish to invest in large scale projects. A P4P programme could be found in many configurations, but in essence is a multi-actor arrangement in which financial compensation is rewarded based on metered energy savings.

Financing for renovation projects

In the EU, we mostly see energy retrofits financed through credit financing, leasing financing, project financing, cession and/or forfaiting on a project-by-project basis. As more EE finance projects become 'bankable' through aggregation due to (i) the derisking of investments through guarantees of financial payback of EE measures for investors or public subsidy providers at the programme level and (ii) the generation of income from providing benefits to the power system thereby improving the business case of energy retrofits in buildings, innovative energy efficiency contracting and financing options such as P4P may find fertile soil.

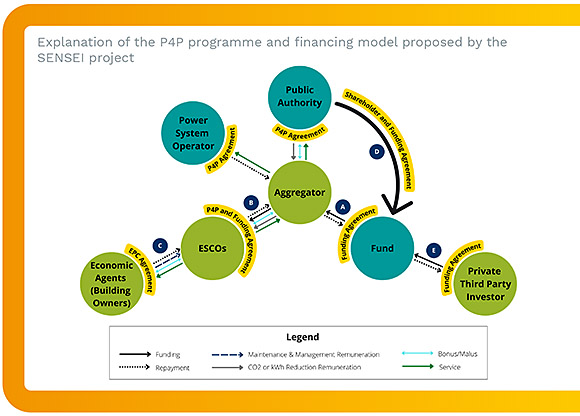

In order to understand the basic European P4P model suggested by the SENSEI project, one must become familiarised with the main actors involved, including Aggregators, ESCOs, Economic Agents, the Public Authority, the System Operator, the Fund and the Private Third Party Investors. The configuration of actors proposed by the project foresees Aggregators at the center of the model, coordinating the realization of renovation projects in different sectors, for which they receive an agreed remuneration (e.g. EUR/ kWh or EUR/tCO2) from the Public Authority based on the Aggregator’s offer and dependent of metered reduction.

In order to understand the basic European P4P model suggested by the SENSEI project, one must become familiarised with the main actors involved, including Aggregators, ESCOs, Economic Agents, the Public Authority, the System Operator, the Fund and the Private Third Party Investors. The configuration of actors proposed by the project foresees Aggregators at the center of the model, coordinating the realization of renovation projects in different sectors, for which they receive an agreed remuneration (e.g. EUR/ kWh or EUR/tCO2) from the Public Authority based on the Aggregator’s offer and dependent of metered reduction.

As the Aggregators receive public money (A), a public procurement and tendering procedure must take place. The Aggregator with the best offer for a sector will implement the P4P programme. With this, the aggregator funds an ESCO’s investment in energy efficiency projects (B), and thus should conclude a funding agreement with the ESCO. The ESCO in turn concludes an energy performance contracting agreement with an Economic Agent (e.g. a building management company or the building owner) for the specific project (C). This lays out the minimum energy cost savings that the ESCO guarantees, via a bonus or malus system. The building owner does not have to fund the investments of the energy efficiency project and only pays the ESCO a yearly remuneration, composed of repayment, maintenance and management fees and a bonus/malus fee.

The Public Authority capitalizes the Fund at the required equity level, especially at the start of the Fund in order to attract Private Third-Party Investors and financial institutions at senior or subordinated debt levels. The Fund can be part of the Public Authority or can be an autonomous public entity found by the Public Authority.

The Public authority acts as primary shareholder and receives a double dividend (D), namely the financial dividend and policy dividend via energy demand or CO2 reduction. Additionally, it holds the starting equity of the Fund and possible additional debt. Private Third Party Investors finance the Fund (E) and receive repayment according to the risk level and market conditions. Lastly, Fund managers provide general corporate services to the fund such as accounting, taxes, auditing, asset and liability management, as well as tasks related to the EE projects’ funding position.

Within the P4P model, there is a certain degree of flexibility in terms of funding opportunities, such as direct funding of Aggregators by Private Third Party Investors, of ESCOs by the Fund, or of Economic Agents by the Fund. The feasibility of a particular financing programme often depends on a combination of factors, from project size and anticipated payback period to utility incentives/rebates and security features.

A stepwise approach to piloting Pay-for-Performance programmes

The above-mentioned advancements in metered savings and energy efficiency project finance create the possibility of setting up innovative financing programmes based on the Pay-for-Performance approach. These programmes would help increase renovation rates and make buildings more responsive to the needs of the power system. Based on experience from the US, where Payfor- Performance programmes have been running for about a decade, the SENSEI project proposes a process for establishing the first EU Pay-for- Performance pilots using a stepwise approach:

- Securing high-level commitments to pilot EE programs from actors such as ministries, public authorities and power system operators;

- Facilitating the design of a P4P programme including all market parties involved, role descriptions and contractual and financial flows in collaboration with a competent managing authority and/or a system operator;

- Selecting an existing energy efficiency programme with plentiful availability of energy performance data for which energy savings are conventionally calculated and rewarded;

- Using performance data to estimate probable energy savings if the programme had been organized as a P4P programme and analysing the results to improve the initial P4P model;

- Launching tenders for EE projects with a compensation structure bases on metered savings; and

- Setting up a first P4P pilot programme by upgrading an existing EE programme in collaboration with various stakeholders.

To learn more about the benefits and opportunities of Pay-for-Performance schemes in the EU, please visit SENSEI's website at https://senseih2020.eu/, or contact SENSEI's project coordinator Filippos Anagnostopoulos at filippos@ieecp.org.

This project has received funding from the European Union's Horizon 2020 Research and Innovation program under Grant Agreement No 847066.