Page 32 - European Energy Innovation magazine - spring 2023 edition

P. 32

Spring 2023 European Energy Innovation

32 COMMUNICATION

PV, roughly 50% for onshore wind and

34% for offshore wind), which are also

Figure 4 affected by the relatively low price

levels of the considered scenario. An

exception exists, as PV systems in

the Iberian electricity market (MIBEL)

were found to be profitable on an

EOM basis.

The 2019 simulations of MIBEL

and the Portuguese and Spanish

ancillary services and imbalance

settlements enabled to calibrate the

MASCEM and RESTrade models to

obtain close-to real-world results.

For the second iteration of these

markets, S1-S4 scenarios will be

addressed, assessing the impact of

temporal and sectoral flexibilities

and the performance of new market

design bundles for RES-dominated

scenarios. In what concerns ancillary

services markets, the Portuguese and

Spanish control zones have different

rules for vRES market players. In

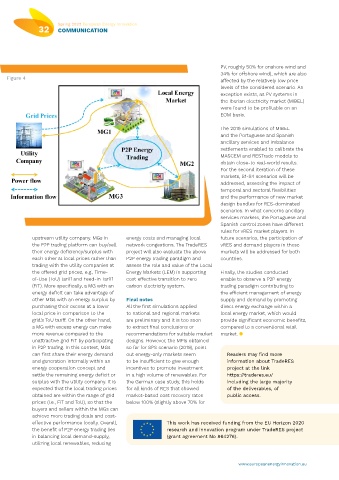

upstream utility company. MGs in energy costs and managing local future scenarios, the participation of

the P2P trading platform can buy/sell network congestions. The TradeRES vRES and demand players in these

their energy deficiency/surplus with project will also evaluate the above markets will be addressed for both

each other at local prices rather than P2P energy trading paradigm and countries.

trading with the utility companies at assess the role and value of the Local

the offered grid prices, e.g., Time- Energy Markets (LEM) in supporting Finally, the studies conducted

of-Use (ToU) tariff and Feed-in Tariff cost effective transition to zero enable to observe a P2P energy

(FiT). More specifically, a MG with an carbon electricity system. trading paradigm contributing to

energy deficit can take advantage of the efficient management of energy

other MGs with an energy surplus by Final notes supply and demand by promoting

purchasing their excess at a lower All the first simulations applied direct energy exchange within a

local price in comparison to the to national and regional markets local energy market, which would

grid's ToU tariff. On the other hand, are preliminary and it is too soon provide significant economic benefits,

a MG with excess energy can make to extract final conclusions or compared to a conventional retail

more revenue compared to the recommendations for suitable market market. l

unattractive grid FiT by participating designs. However, the MPIs obtained

in P2P trading. In this context, MGs so far for SPS scenario (2019), point

can first share their energy demand out energy-only markets seem Readers may find more

and generation internally within an to be insufficient to give enough information about TradeRES

energy cooperation concept and incentives to promote investment project at the link

settle the remaining energy deficit or in a high volume of renewables. For https://traderes.eu/

surplus with the utility company. It is the German case study, this holds including the large majority

expected that the local trading prices for all kinds of RES that showed of the deliverables, of

obtained are within the range of grid market-based cost recovery rates public access.

prices (i.e., FiT and ToU), so that the below 100% (slightly above 70% for

buyers and sellers within the MGs can

achieve more trading deals and cost-

effective performance locally. Overall, This work has received funding from the EU Horizon 2020

the benefit of P2P energy trading lies research and innovation program under TradeRES project

in balancing local demand-supply, (grant agreement No 864276).

utilizing local renewables, reducing

www.europeanenergyinnovation.eu