Page 31 - European Energy Innovation magazine - spring 2023 edition

P. 31

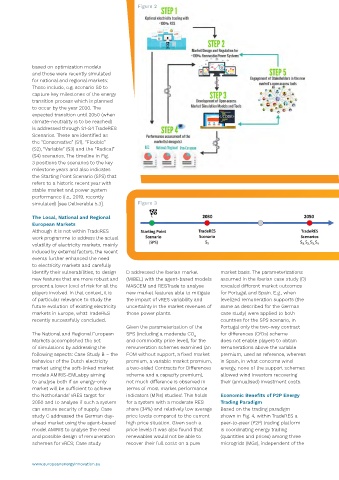

Figure 2

based on optimization models

and those were recently simulated

for national and regional markets:

These include, e.g. scenario S0 to

capture key milestones of the energy

transition process which is planned

to occur by the year 2030. The

expected transition until 2050 (when

climate-neutrality is to be reached)

is addressed through S1-S4 TradeRES

Scenarios. These are identified as

the “Conservative” (S1), “Flexible”

(S2), “Variable” (S3) and the “Radical”

(S4) scenarios. The timeline in Fig.

3 positions the scenarios to the key

milestone years and also indicates

the Starting Point Scenario (SPS) that

refers to a historic recent year with

stable market and power system

performance (i.e., 2019, recently

simulated) [see Deliverable 5.3]. Figure 3

The Local, National and Regional

European Markets

Although it is not within TradeRES

work programme to address the actual

volatility of electricity markets, mainly

induced by external factors, the recent

events further enhanced the need

to electricity markets and carefully

identify their vulnerabilities, to design D addressed the Iberian market market basis. The parameterizations

new features that are more robust and (MIBEL) with the agent-based models assumed in the Iberian case study (D)

present a lower level of risk for all the MASCEM and RESTrade to analyse revealed different market outcomes

players involved. In that context, it is new market features able to mitigate for Portugal and Spain. E.g., when

of particular relevance to study the the impact of vRES variability and levelized remuneration supports (the

future evolution of existing electricity uncertainty in the market revenues of same as described for the German

markets in Europe, what TradeRES those power plants. case study) were applied to both

recently successfully concluded. countries for the SPS scenario, in

Given the parameterisation of the Portugal only the two-way contract

The National and Regional European SPS (including a moderate CO for differences (CfDs) scheme

2

Markets accomplished the set and commodity price level), for the does not enable players to obtain

of simulations by addressing the remuneration schemes examined (an remunerations above the variable

following aspects: Case Study B – the EOM without support, a fixed market premium, used as reference, whereas

behaviour of the Dutch electricity premium, a variable market premium, in Spain, in what concerns wind

market using the soft-linked market a two-sided Contracts for Differences energy, none of the support schemes

models AMIRIS-EMLabpy aiming scheme and a capacity premium), allowed wind investors recovering

to analyse both if an energy-only not much difference is observed in their (annualised) investment costs.

market will be sufficient to achieve terms of most market performance

the Netherlands’ vRES target for indicators (MPIs) studied. This holds Economic Benefits of P2P Energy

2050 and to analyse if such a system for a system with a moderate RES Trading Paradigm

can ensure security of supply. Case share (34%) and relatively low average Based on the trading paradigm

study C addressed the German day- price levels compared to the current shown in Fig. 4, within TradeRES a

ahead market using the agent-based high price situation. Given such a peer-to-peer (P2P) trading platform

model AMIRIS to analyse the need price levels it was also found that is coordinating energy trading

and possible design of remuneration renewables would not be able to (quantities and prices) among three

schemes for vRES; Case study recover their full costs on a pure microgrids (MGs), independent of the

www.europeanenergyinnovation.eu