Page 16 - European Energy Innovation magazine - autumn 2022 edition

P. 16

Autumn 2022 European Energy Innovation

16 BIOGAS AND BIOMETHANE

A new policy context for

assessing biogas and

biomethane

By Peter Zeniewski, Energy Analyst at International Energy Agency (IEA)

he EU’s biogas and and environmental regulations. procedures, factory-style fabrication

biomethane industry is The EU plan encourages national of standardised biodigesters and

growing, and has been biomethane strategies to evaluate related equipment, dedicated biogas

Tgiven a large boost by potential and identify barriers to fi nancing facilities, and robust

the RePowerEU plan, which aims production as well as enabling support schemes such as quotas,

to achieve a target of at least 35 conditions at the local and national feed-in tariffs, and contracts for

bcm (350 TWh) annual biomethane levels. It also suggests an integration difference, in addition to an EU-

production by 2030. of biomethane into an EU-wide wide system for low-carbon gases

strategy for rural development and certifi cation.

There are many EU and national local job creation, including the use

policies already in place that of energy communities and farmers Potential and costs of biomethane

support biogas and biomethane, cooperatives. in the EU

and several near-term actions are The IEA has produced country-level

proposed in the RePowerEU plan to The growth in biomethane production estimates of the feedstock potential

support its development. An industry envisioned in the RePowerEU plan within the European Union, using

partnership has been proposed would imply a 40% average annual Eurostat, FAO and World Bank data.

that would serve as a platform for growth rate from 2023-30 compared The largest potential lies in Germany,

public-private engagement and the to 17% between 2015-2021. Factors France, Spain and Italy, owing to their

sharing of best practices around that could accelerate growth size, population and relatively large

permitting, fi nancing, incentives include streamlined permitting gross agricultural output. Comparing

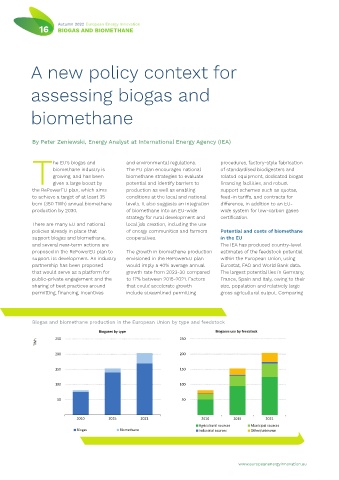

Biogas and biomethane production in the European Union by type and feedstock

Biogases by type Biogases use by feedstock

250 250

TWh

200 200

150 150

100 100

50 50

2010 2015 2021 2010 2015 2021

Agricultural sources Municipal sources

Biogas Biomethane Industrial sources Other/unknown

www.europeanenergyinnovation.eu